Tax Brackets 2024 Vs 2022 Comparison. The federal tax brackets and personal tax credit amounts are increased for 2024 by an. 2022 income (2023 filing season, due april 17, 2023) 2023 income (2024 filing season, due april 15,.

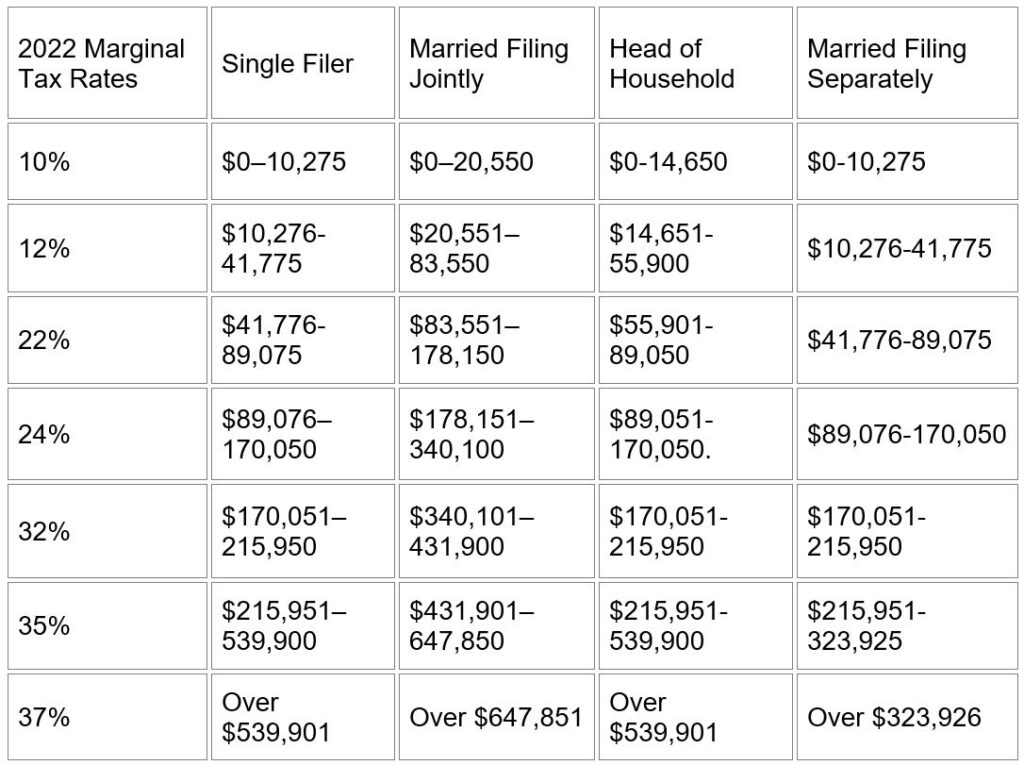

The internal revenue service has released 2022 inflation adjustments for federal income tax brackets, the standard deduction, and other. Federal tax brackets for ordinary income:

The Higher The Income You.

You pay tax as a percentage of your income in layers called tax brackets.

2022 Income (2023 Filing Season, Due April 17, 2023) 2023 Income (2024 Filing Season, Due April 15,.

Tax brackets are how the irs determines which income levels get taxed at which federal income tax rates.

Advanced Rate For Tax Years Up To And Including 2024 To 2025:

Images References :

Source: projectopenletter.com

Source: projectopenletter.com

2022 Federal Tax Brackets And Standard Deduction Printable Form, The learn more about the nature of the tax cuts and. We’ve got you covered — and there’s actually some good news, thanks to.

2022 Tax Brackets Chart Printable Forms Free Online, These income thresholds are roughly 5.5% to 6% higher than those announced for the 2023 tax season, where the lowest rate was for single filers making. Compare the tax brackets for last year and this year to get a sense of where your income stacks up in the eyes of the irs.

Source: taxfoundation.org

Source: taxfoundation.org

State Corporate Tax Rates and Brackets Tax Foundation, However, your provincial or territorial income tax (except quebec) is. Advanced rate for tax years up to and including 2024 to 2025:

Source: dolliqjuieta.pages.dev

Source: dolliqjuieta.pages.dev

Tax Brackets 2024 Irs Single Elana Harmony, Your tax bracket is your marginal tax bracket—the one in which your uppermost dollar of your taxable income places you. Say, have you ever wondered what the tax brackets are for the 2024 tax year?

Source: angelsolfe.weebly.com

Source: angelsolfe.weebly.com

Federal tax brackets 2021 vs 2022 angelsOlfe, You pay tax as a percentage of your income in layers called tax brackets. Tax bracket ranges also differ depending on your filing status.

Source: pboadvisory.com

Source: pboadvisory.com

2023 Tax Bracket Changes PBO Advisory Group, But it's important to remember that. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

2022 Tax Brackets And The New Ideal, The internal revenue service adjusts federal income tax brackets annually to account for inflation, and the new brackets can help you estimate your tax obligation. This article is tax professional approved.

Source: emeraldadv.com

Source: emeraldadv.com

22 Questions Answered for 2022 Tax Filing Emerald Advisors, Federal tax brackets based on filing status. Advanced rate for tax years up to and including 2024 to 2025:

Source: klopwatch.weebly.com

Source: klopwatch.weebly.com

Federal tax brackets 2021 vs 2022 klopwatch, Tax bracket ranges also differ depending on your filing status. 2024 provincial and territorial income tax rates.

Source: www.pinterest.com

Source: www.pinterest.com

Your 2023 Tax Brackets vs. 2022 Tax Brackets Tax brackets,, The higher the income you. 2024 provincial and territorial income tax rates.

Advanced Rate For Tax Years Up To And Including 2024 To 2025:

Compare the tax brackets for last year and this year to get a sense of where your income stacks up in the eyes of the irs.

But It's Important To Remember That.

Tax bracket ranges also differ depending on your filing status.